|

|

| US data 15-minute delayed Incredible Charts now offers 15-minute delayed data for NYSE, NASDAQ, AMEX, OTCBB & OTC Market stocks, and Dow Jones global index series.

|

Euro weak while Aussie dollar strengthens

By Colin Twiggs

February 9th, 2012 2:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The euro is testing resistance around $1.32 but the primary down-trend is strong. With 63-day Twiggs Momentum deep below zero, expect another test of primary support at $1.26. Breakout remains likely and would offer a target of $1.20*.

* Target calculations: 1.26 - ( 1.32 - 1.26 ) = 1.20

The Aussie dollar has surged ahead of the CRB Commodities Index which it tracks quite closely. Breakout above $1.08 would signal a primary advance to $1.20*.

* Target calculations: 1.08 + ( 1.08 - 0.96 ) = 1.20

Canada's Loonie shows a similar pattern, testing resistance at $1.01. Breakout would offer a target of $1.06*.

* Target calculations: 1.01 + ( 1.01 - 0.96 ) = 1.06

Pound Sterling followed through above the descending trendline, indicating that the primary down-trend is over. Recovery of 63-day Twiggs Momentum above zero would strengthen the signal. Only a breakout above 41.62, however, would signal the start of a primary up-trend.

The greenback continues to test support against the Japanese Yen at ¥76. Breakout would signal another decline, this time with a target of ¥72*. Long-term bullish divergence on 63-day Twiggs Momentum, however, indicates that the down-trend is slowing; breach of the descending trendline would strengthen the signal. Recovery above ¥80 would start a primary up-trend.

* Target calculations: 76 - ( 80 - 76 ) = 72

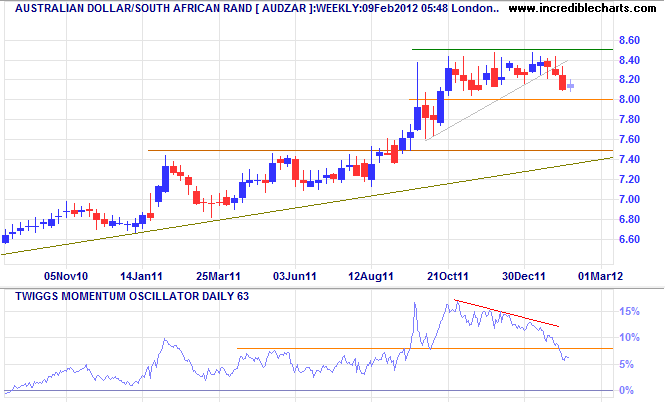

The South African Rand unexpectedly broke downwards from its bullish ascending triangle against the Aussie Dollar; follow-through below R8.00 would signal a correction to R7.50 (and the long-term trendline).

More....

| |

Gold up-trend not yet confirmed

Commodities: Copper and crude rise for different reasons

Brent oil on tear with Iran sanctions, Europe winters - Commodities - Futures Magazine

US Labor Force Participation Rates

New Economic Perspectives: Banks Weren't Meant to Be Like This. What Will their Future Be — and What is the Government's Proper Financial Role?

Peter Schiff Speaks to James Rickards, Author of Currency Wars - Peter Schiff - Safehaven.com

Westpac Economic Update: RBA leaves rates unchanged

Lady, I do not make up things. That is lies. Lies are not true. But the truth could be made up if you know how. And that's the truth.

~ Lily Tomlin

| | Customize Your Newsletter Profile Receive only those newsletters which match your interests. |